In recent years, the forex trading landscape has dramatically changed, with the advent of artificial intelligence (AI) technologies. Traders are increasingly adopting AI algorithms to make more informed decisions and improve their trading strategies. As we delve into the innovative world of ai forex trading Top Sharia Forex Platforms and AI, it’s essential to understand how these technologies are shaping the future of currency trading.

Understanding AI in Forex Trading

Artificial intelligence in forex trading refers to the simulation of human intelligence processes by computer systems. This technology encompasses machine learning, natural language processing, and data analytics, among other tools. By utilizing vast amounts of data and intricate algorithms, AI analyzes market trends and makes predictions on currency price movements.

The Benefits of AI in Forex Trading

One of the primary advantages of AI in forex trading is its ability to process large data sets rapidly. Traditional trading strategies often rely heavily on human analysis, which can be time-consuming and prone to error. AI systems can eliminate these inefficiencies by analyzing data patterns in real-time, enabling traders to make quick decisions based on accurate forecasts.

Enhanced Decision Making

AI-driven systems provide traders with insights that are rooted in data analysis rather than gut feelings. For example, AI can evaluate economic indicators, market sentiment, and historical price movements simultaneously, offering a more comprehensive view of potential market direction.

Automation and Algorithmic Trading

The integration of AI into trading platforms has led to the rise of automated trading systems and algorithms. These systems can execute trades automatically based on predefined criteria, reducing the emotional aspect of trading that often leads to costly mistakes. As a result, traders can maintain discipline and consistency in their strategies.

Risk Management

Effective risk management is crucial in forex trading. AI can help traders identify potential risks by analyzing market volatility and predicting unfavorable market conditions. Through this analysis, traders can set appropriate stop-loss levels and adjust their portfolios accordingly, safeguarding their investments.

How AI is Changing Trading Strategies

The introduction of AI has led to revolutionary changes in trading strategies. Traders now leverage complex algorithms tailored to their individual trading styles and risk appetites. Here are a few ways AI is reshaping trading strategies:

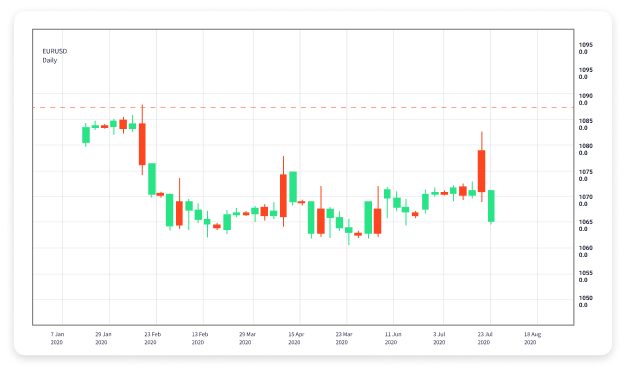

Pattern Recognition

AI excels at recognizing patterns that might be invisible to human traders. By analyzing historical price movements and identifying trends, AI can predict future price changes. This capability is invaluable for developing trading strategies that capitalize on anticipated market movements.

Sentiment Analysis

Market sentiment can heavily influence currency prices. AI tools can analyze vast amounts of news articles, financial reports, and social media activity to gauge market sentiment. By understanding the collective mood of the market, traders can make more educated choices regarding their trading actions.

Adaptive Learning

Another fascinating aspect of AI in forex trading is its capacity for adaptive learning. As the market evolves, AI systems can adjust their algorithms and strategies accordingly, ensuring traders stay ahead of market trends. This adaptability is vital in a market where conditions change rapidly.

Challenges and Considerations

While the benefits of AI in forex trading are substantial, there are also challenges that traders must consider. The reliance on technology introduces risks related to system failures and data integrity. It’s crucial for traders to stay informed and maintain a degree of skepticism toward AI-generated predictions.

Market Overreliance on Algorithms

One concern is the potential for market overreliance on algorithms, which can lead to flash crashes and sudden market volatility. If too many traders rely on similar AI-generated signals, it can create herding behavior, exacerbating market fluctuations.

Ethical Considerations

The use of AI in trading raises ethical questions as well. Issues related to data privacy, algorithmic transparency, and fair access to technology must be addressed. Traders should ensure that their AI tools comply with regulatory standards and ethical guidelines.

The Future of AI in Forex Trading

The future of forex trading is undeniably intertwined with AI. As technology continues to advance, we can expect even more sophisticated trading systems that offer enhanced prediction accuracy and risk management capabilities. Traders who adapt to these changes and incorporate AI into their strategies will likely find themselves at a competitive advantage.

Continued Innovation

Companies and developers are continually innovating, introducing new algorithms and AI-driven tools to the market. The proliferation of AI in trading platforms signifies that the forex market will become more data-driven, providing traders with unprecedented insights and opportunities.

Regulatory Landscape

As AI becomes more prevalent in forex trading, regulatory bodies are likely to create frameworks that focus on managing the use of AI technologies. Traders should stay informed about regulatory changes and ensure their practices comply with evolving standards.

Conclusion

AI is undeniably transforming the forex trading landscape by enhancing decision-making, automating processes, and providing advanced risk management solutions. While there are challenges to consider, the benefits of integrating AI into trading strategies are clear. As traders embrace these technologies, they must remain vigilant, adapting to the ever-evolving market dynamics and regulatory environment. The future of forex trading is here, and it is powered by artificial intelligence.